In a successful business, payroll is more than just a monthly task, it is a promise to employees: “You will get paid accurately and on time, every time.” If you fail to keep this promise even once, it can harm trust, productivity, and your reputation. Many growing companies in Africa struggle with payroll management due to issues like tax deductions, leave adjustments, unpredictable attendance, and compliance with local laws. They also need to keep costs low and HR teams efficient.

This guide explains how PahappaHR can help you simplify payroll management in a way that focuses on people, is efficient, and prepares you for the future. Whether you run a startup, an NGO, or a small to medium-sized enterprise with at least 10 employees anywhere in Africa, this guide will help you manage payroll confidently.

Why Payroll Is Important: It’s More Than Just Paychecks

Payroll is not just about transferring money; it is essential for several reasons:

- Trust: When employees see that their pay is accurate and reliable, they feel more valued and are likely to stay loyal to the company.

- Legal Responsibility: It’s important to handle deductions and submissions correctly. If you make a mistake, it can lead to fines and audits.

- Costs: Payroll is usually one of the biggest regular expenses for a business. Managing it well helps you plan your finances better.

In Africa, getting payroll right is even more important. Mistakes can be very expensive. A single error can hurt employee trust. Workforce Africa reports that ongoing payroll problems can push workers to seek new jobs. Local rules, complicated tax systems, and issues with banking make having a strong payroll system essential.

The Common Payroll Headaches African SMEs Face

Before we talk about solutions, let’s identify the main challenges that many HR teams in Africa face:

- Changing and Confusing Regulations: Each country, and sometimes regions within them, have different rules for income tax, social security, contributions, minimum wage, and reporting.

- Manual Calculations and Spreadsheets: Many HR teams still rely on Excel or unconnected tools. This leads to mistakes and extra work.

- Leave and Attendance Issues: If leave isn’t linked correctly, it complicates payroll calculations.

- Banking and Cash-flow Problems: In some areas, employees don’t have bank accounts, forcing companies to use cash or mobile money for payments.

- Costly Errors and Penalties: Global surveys show that common payroll mistakes include wrong wage calculations (48%), late payments (38%), incorrect hours (36%), and tax errors (27%). In Africa, the impact is worse due to currency fluctuations and strict regulations.

How PahappaHR Solves Payroll: Core Features That Matter

PahappaHR is more than just a payroll tool; it is a complete HR platform designed to solve the challenges mentioned earlier. Here’s how it works:

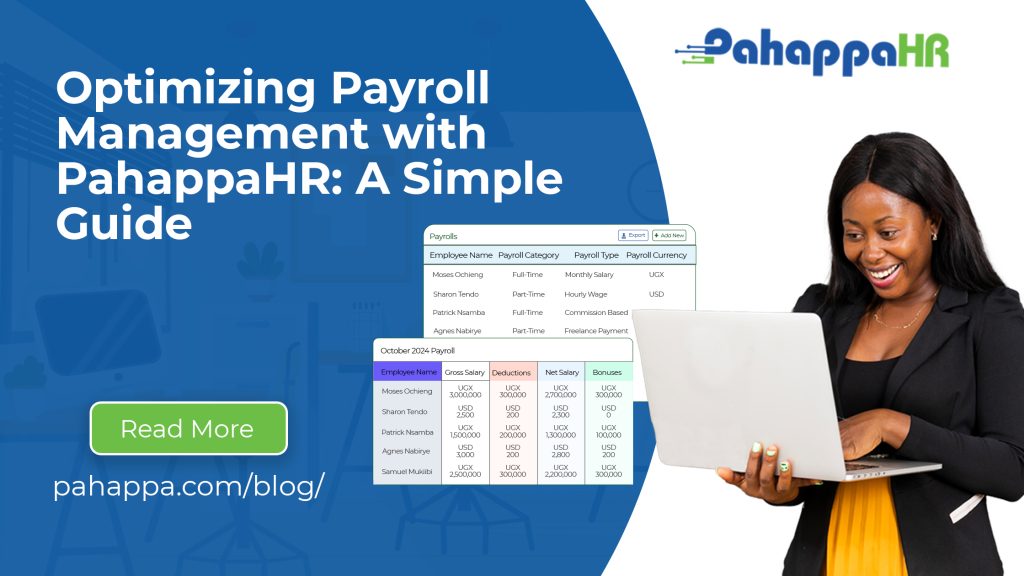

Automated Payroll and Deductions

With PahappaHR, you can run payroll easily with just one click. The system automatically calculates salaries, bonuses, allowances, and deductions based on set rules, reducing the chance of mistakes and ensuring consistency.

Attendance and Timesheet Integration

PahappaHR connects with clock-in/out records, mobile check-ins, and timesheets, so you only pay for the hours worked. This eliminates double entries and ensures no hours are missed.

Leave and Payroll Connection

The system includes leave data, automatically adjusting salaries for leave days, unpaid leave, or absences. This prevents errors that often happen in manual processes.

Compliance and Reporting Tools

PahappaHR provides templates for legal requirements, helps with submissions, keeps audit trails, and allows for customizable reports based on local labor laws. You’ll have all the necessary data for audits or regulatory requests.

Employee Self-Service

Employees can access their payslips, tax documents, leave balances, and personal information. This cuts down on HR requests and promotes transparency.

Together, these features make running payroll easier and give your business a competitive edge.

Real Benefits for Businesses Using PahappaHR

When you use PahappaHR for payroll, you get several important benefits:

- Save Time and Focus on Strategy: HR teams can move from handling administrative tasks to planning for the future. Many organizations see a big drop in payroll processing time thanks to automation.

- Reduce Errors and Penalties: Automated checks and rules help cut down on mistakes and compliance issues.

- Increase Transparency and Trust: Employees can view their payslips and understand their deductions. This builds trust and lowers the chances of pay disputes.

- Affordable and Scalable: With PahappaHR’s subscription model, you can easily grow from small teams to larger ones without high costs.

Make Better Decisions: Accurate payroll data helps with workforce planning, budgeting, and HR strategies.

A Simple 5-Step Payroll Optimization Checklist Using PahappaHR

Here’s how you and your team can optimize payroll through practical steps:

- Centralize Employee Data: Make sure every employee record includes essential information such as contracts, tax IDs, bank details, benefits, and job roles.

- Enable Attendance and Leave Integration: Link your timesheet and leave management systems so that data flows into payroll automatically.

- Configure Statutory and Deduction Rules: Set up local tax rates, social security requirements, allowances, and formulas for deductions.

- Conduct Payroll Review and Approval: Utilize built-in workflows for reviewing and approving payroll before finalizing payments.

- Distribute Payslips and File Reports: Automatically publish payslips, schedule regular payroll runs, and export reports for regulatory compliance or auditing.

By following these steps, you can establish a disciplined rhythm for ensuring reliable and repeatable payroll processes.

Conclusion

Payroll can be simple and stress-free. With PahappaHR, you gain a reliable system that supports your employees and helps your business grow. We automate calculations, combine leave and timesheets, ensure compliance, and provide transparency. This allows your HR and finance teams to focus on leadership rather than just administration. Are you ready to feel confident about payroll? Book a demo with PahappaHR today to see how we can customize payroll for your country.

FAQs

Q: How does PahappaHR manage taxes and deductions in different African countries?

A: PahappaHR follows the specific rules for taxes and social security in each country. It updates regularly to keep up with any changes in the law, so your payroll stays compliant.

Q: Can PahappaHR work with biometric attendance systems?

A: Yes, PahappaHR can connect with attendance devices and mobile clock-ins, so this data goes straight to payroll.

Q: Can I customize the payroll setup for different payment schedules, like monthly or bi-weekly?

A: Yes, you can set up pay cycles, pay periods, allowances, and workflows to match your organization’s needs.

Q: Does PahappaHR provide year-end reports and tax forms?

A: Yes, the system produces exportable reports for audits, tax authorities, and regulatory filings.

Q: How secure is employee payroll data?

A: PahappaHR uses encryption, role-based access, and audit logs to keep sensitive payroll information safe and accessible only to authorized users.